By Siddhant Kejriwal

Compiled by: Glendon, Techub News

As the cryptocurrency industry has developed to date, staking has become an indispensable cornerstone and plays an important role in network security and investor participation. By participating in staking, individuals can not only contribute to the stable operation of the blockchain network, but also unlock opportunities to earn passive income. Specifically, the benefits of participating in staking include:

1. Strengthening cryptoeconomic security: In essence, staking involves locking a certain amount of cryptocurrency to support the operation of the blockchain network. This process is particularly critical for proof-of-stake (PoS) blockchains, where validators confirm transactions based on the amount of cryptocurrency they stake. This mechanism ensures the security of the network and closely aligns the interests of participants with the healthy development of the blockchain.

2. Earn passive income: In addition to enhancing network security, staking also provides attractive economic incentives. By staking assets, investors can earn rewards, usually in the form of additional cryptocurrency tokens. This form of income generation meets the needs of both new and experienced investors who are looking to maximize returns without actively trading. In some projects, staking may also involve airdrop activities, providing additional asset appreciation opportunities for stakers.

3. Launching new projects through re-staking: One of the latest innovations in the staking space is “Restaking”, which enables staked assets to be reused across multiple protocols. This approach allows new projects to leverage the security and capital of existing networks, effectively bootstrapping their development. For example, platforms such as EigenLayer facilitate re-staking by allowing users to stake their ETH or liquid staking tokens and extend cryptoeconomic security to other applications on the network, bringing further benefits to investors.

It should be noted that while re-staking provides investors with the opportunity to increase returns and enhance network support, it also comes with some complexities and risks that cannot be ignored. As 2025 approaches, the DeFi staking space will continue to flourish, providing investors with more options. This article will take you through the top DeFi staking platforms that are worth paying close attention to.

DeFi staking involves locking cryptocurrency assets in smart contracts to support the operation of blockchain networks, especially those that use the Proof of Stake (PoS) consensus mechanism. In PoS networks, validators confirm transactions and create new blocks based on the amount of cryptocurrency they stake. Staking usually requires deploying a full node and meeting the network's minimum staking requirements, which enables participants to verify transactions and participate in network consensus to receive rewards.

Key concepts in DeFi staking

Smart contracts and staking contracts: Smart contracts are self-executing agreements encoded on the blockchain that ensure the staking process is automated, transparent, and secure. When you stake tokens, you actually become a validator (or delegator) of the network, working together to maintain the security and stability of the network. In return, you will receive rewards in the form of new tokens or a share of transaction fees.

Staking Rewards: Staking rewards typically include newly minted tokens and a share of transaction fees to incentivize participants to contribute to network security and operations.

Punishment mechanism: In order to maintain the integrity of the network, the PoS network implements a penalty mechanism called "Slashing", which reduces the staked funds of validators if they engage in malicious activities or fail to perform their duties. This mechanism is designed to curb the occurrence of improper behavior.

DeFi Staking vs. Centralized Staking

When comparing DeFi staking to centralized staking services, the following key factors stand out:

Ownership: DeFi staking allows users to retain actual ownership of their assets because they control their own private keys. In contrast, centralized staking requires users to entrust their assets to a third party, giving up direct control.

Transparency: DeFi platforms run on open-source smart contracts, providing a transparent staking process and reward distribution. Centralized platforms may lack this transparency, making it difficult for users to verify how rewards are calculated and distributed.

Security and Control: DeFi staking gives users greater control over their assets, reduces reliance on intermediaries, and reduces counterparty risk. Centralized staking involves entrusting assets to a platform, which can pose security risks if the platform is attacked.

Mechanism: In DeFi staking, users delegate their stake to a permissionless validator network and directly participate in the network's consensus mechanism. Centralized staking platforms pool user funds and use validators selected by the platform to stake, usually without disclosing the specific details of the process.

Learning curve: DeFi staking can be complex, requiring users to navigate various platforms and manage private keys, which can be challenging for beginners. Centralized platforms offer a more user-friendly, Web2-like experience that simplifies the staking process at the expense of decentralization.

in conclusion

Choosing between DeFi and centralized staking platforms comes down to personal preference, especially regarding control, transparency, and ease of use. Next, this article will explore the top DeFi staking platforms expected to make an impact in 2025 and provide some insights.

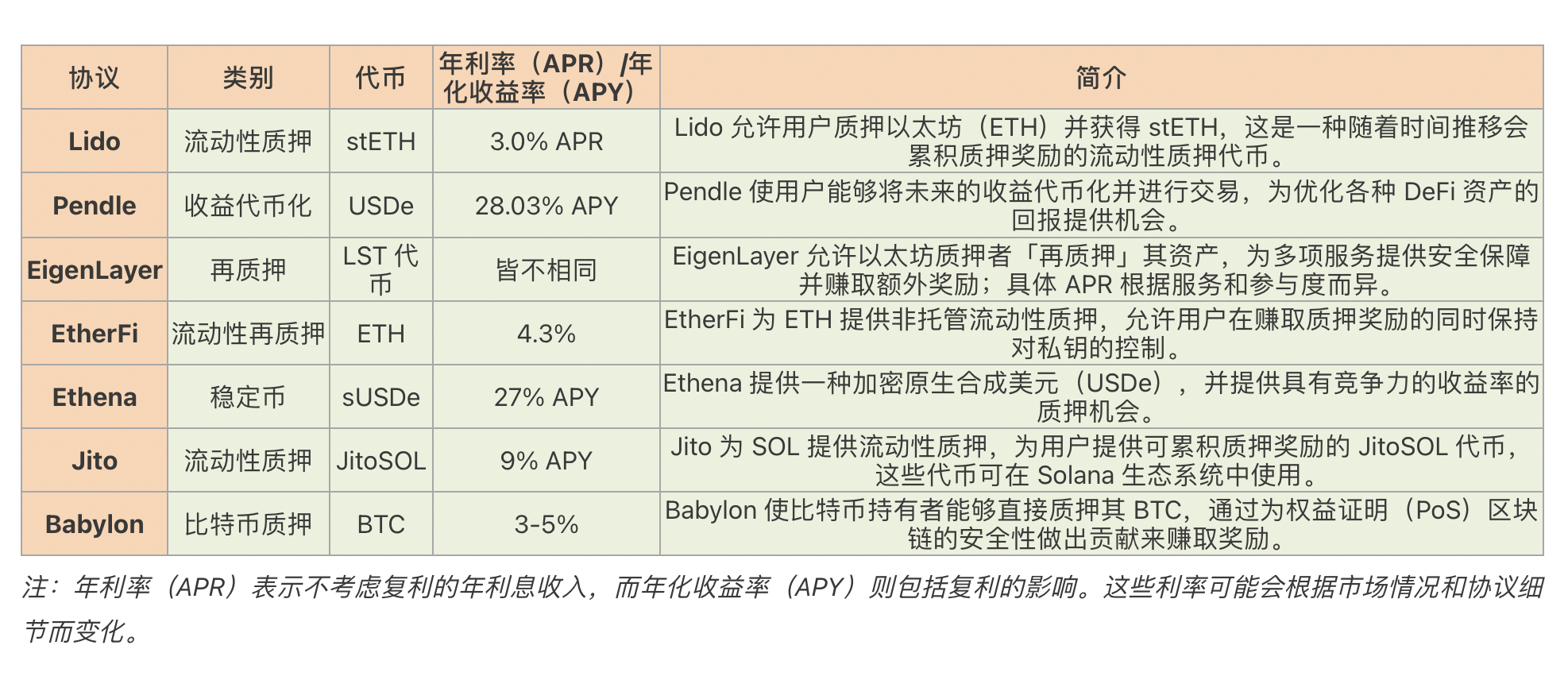

Below is a comprehensive overview of the DeFi staking protocols we’ll be discussing, focusing on their main features, associated tokens, and current annual percentage rates (APR) or annualized percentage yields (APY).

Lido Finance is a DeFi protocol focused on liquidity staking services. It enables users to stake their digital assets on multiple blockchain networks while maintaining liquidity, effectively solving the limitations of traditional staking, such as asset lock-up and high barriers to entry. By issuing liquidity staking tokens (LSTs) such as stETH for Ethereum, Lido allows users to earn staking rewards while using their assets in the broader DeFi ecosystem.

Key Features of Lido Finance

Liquid Staking: Lido’s core service allows users to stake assets without locking them up. It provides staked token derivatives (e.g. stETH) that can be freely transferred, traded, or used in other DeFi protocols.

Decentralized Governance: Managed by the Lido Decentralized Autonomous Organization (DAO), Lido ensures that decisions regarding protocol parameters, node operator selection, and fee structure are made collectively by LDO token holders.

Security Measures: Lido employs experienced node operators and conducts regular audits to maintain the integrity and security of the staking process and minimize risks such as penalty slashing.

DeFi Integration: Lido’s liquidity staking tokens have been widely accepted on various DeFi platforms, enabling users to participate in activities such as lending and yield farming while earning staking rewards.

Supported staking tokens

Lido supports staking of multiple cryptocurrencies across different networks, including:

Ethereum (ETH): Stake ETH and get stETH.

Polygon (MATIC): Stake MATIC and get stMATIC.

Solana (SOL): Stake SOL and earn stSOL.

Polkadot (DOT): Stake DOT and get stDOT.

Kusama (KSM): Stake KSM and get stKSM.

LDO Tokens and Their Utility

Lido’s native token, LDO, plays several key roles in the ecosystem:

Governance: LDO holders participate in the Lido DAO and vote on key decisions such as protocol upgrades, fee structure, and selection of node operators.

Incentives: LDO tokens can be used to incentivize liquidity providers and users who contribute to the growth and stability of the Lido protocol.

Summarize

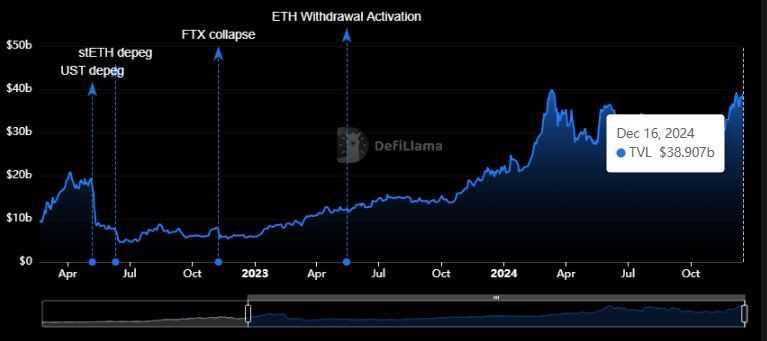

Lido Finance has now consolidated its leading position in the DeFi space. As of December 2024, its total locked value (TVL) is close to an all-time high of $40 billion.

Lido’s growing dominance as the leading LST platform | Chart from DefiLlama

This growth reflects growing user confidence in Lido’s liquidity staking solution and its integration within the DeFi ecosystem. In addition, Lido’s recently launched community staking module enhances decentralization by allowing permissionless node operators to participate, further strengthening the security and resilience of the network.

Pendle Finance is a DeFi protocol that allows users to tokenize and trade the future returns of yield assets. By separating the principal and yield components of an asset, Pendle employs more advanced yield management strategies, including fixed income, speculation on future yield changes, and unlocking liquidity from staked assets. This innovative approach introduces traditional financial concepts, such as interest rate derivatives, into the DeFi space, providing users with greater control and flexibility over their investments.

Key features of Pendle Finance

Yield Tokenization: Pendle allows users to wrap yield tokens into standardized yield (SY) tokens, which are then split into principal tokens (PT) and yield tokens (YT). This separation allows the principal and future yield components to be traded independently, facilitating the implementation of strategies such as locking in fixed income or speculating on yield volatility.

Pendle Automated Market Maker (AMM): Pendle's AMM is designed for time-decaying assets such as YT, providing optimized pricing and minimal slippage. It supports concentrated liquidity and a dynamic fee structure that improves capital efficiency and reduces impermanent loss for liquidity providers.

vePENDLE Governance: Pendle uses a voting custody token model where users can lock PENDLE tokens to receive vePENDLE. This mechanism grants governance rights, allowing holders to participate in protocol decisions, provide direct incentives to specific liquidity pools, and earn a portion of protocol revenue.

Supported collateral assets

Pendle supports a variety of yield assets in multiple blockchain networks, including:

Ethereum (ETH): Pendle allows assets such as stETH (Lido’s liquidity staking token) to be tokenized and traded.

Stablecoins: Tokens from lending protocols like Aave or Compound (e.g. USDC and DAI) can be used in Pendle’s ecosystem.

Other yield tokens: Assets generated by various DeFi protocols can also be integrated into Pendle’s platform.

PENDLE Token and Its Utility

The PENDLE token is the native utility and governance token in the Pendle ecosystem. Its main functions include:

Governance: PENDLE holders can lock their tokens to receive vePENDLE, granting them voting rights to participate in protocol governance decisions such as proposing and voting on upgrades, fee structure, and other key parameters.

Incentives: PENDLE tokens incentivize liquidity providers and users, promoting the growth and stability of the platform. In addition, vePENDLE holders can direct incentives to specific liquidity pools, thereby increasing their returns.

Revenue Sharing: vePENDLE holders are entitled to a share of the protocol’s revenue, aligning the interests of the community with the success of the platform.

Summarize

Pendle Finance has gradually become an important force in the DeFi field by introducing yield tokenization and AMMs dedicated to yield trading. As of December 2024, Pendle's total locked value (TVL) has exceeded US$5 billion (data from DefiLlama ).

Pendle’s integration with multiple DeFi protocols and expansion across various blockchain networks such as Ethereum and Arbitrum further solidifies its position as a versatile and valuable tool for yield management in the DeFi ecosystem.

EigenLayer is an innovative protocol based on Ethereum that introduces the concept of "re-staking", allowing users to reallocate their staked Ethereum (ETH) or Liquid Staking Tokens (LSTs) to enhance the security and functionality of other services built on the Ethereum network. By enabling the reuse of staked assets, EigenLayer promotes a shared security model, as well as the development of application chains and Rollup technologies that do not require independent validator sets.

Main features of EigenLayer

Re-staking mechanism: EigenLayer allows ETH stakers and LST holders to choose to verify new software modules, called Active Verification Services (AVSs), by re-staking assets. This process extends the security of Ethereum to a wider range of applications, including data availability layers, oracle networks, and consensus protocols.

Permissionless Token Support: EigenLayer introduces permissionless token support, enabling any ERC-20 token to be added as a re-staking asset. This extension allows multiple tokens to contribute to the security of the decentralized network, facilitating cross-ecosystem collaboration while enhancing the utility of various tokens.

EigenDA (Data Availability Layer): EigenLayer provides EigenDA, a low-cost data availability solution for Rollups and other Layer 2 solutions. By ensuring data is easily accessible and secure, EigenDA improves the scalability and efficiency of Ethereum-based applications.

Governance and Flexibility: EigenLayer’s architecture allows AVSs to customize their security parameters, including selecting specific tokens for re-staking and defining slashing conditions. This flexibility enables services to tailor security measures to their unique needs, promoting a more resilient and adaptable ecosystem.

Supported re-hypothecation assets

EigenLayer supports multiple assets for re-staking, including:

Ethereum (ETH): Users can participate in the security of other services by re-staking their native staked ETH.

Liquid Staking Tokens (LSTs): Tokens such as stETH and rETH can be re-staked through EigenLayer, allowing holders to receive additional rewards.

ERC-20 Tokens: With permissionless token support, any ERC-20 token can now be added as a re-pledgeable asset.

EIGEN Token and Its Utility

EigenLayer has launched the EIGEN token, a general purpose inter-subject work token designed to enhance the security of the AVS forked protocols supported by EigenLayer. In the face of extreme situations such as active attacks or security vulnerabilities, the EIGEN token can protect these protocols and ensure that the integrity of the blockchain modular stack is not compromised. By combining the EIGEN token with re-staked ETH, EigenLayer provides users with a higher level of crypto-economic security.

Summarize

According to DefiLlama data, EigenLayer's TVL has reached approximately $20.1 billion as of December 2024. As EigenLayer continues to develop, it has always been at the forefront of enhancing Ethereum's security and scalability with its pioneering re-staking protocol, providing users and developers with new opportunities to participate in and build on the Ethereum network.

Ether.fi is a decentralized, non-custodial liquidity staking protocol that empowers Ethereum holders by allowing them to stake their assets while retaining control of their private keys. Ether.fi issues the liquidity staking token eETH, which enables users to earn staking rewards and participate in the broader DeFi ecosystem without the limitations of traditional staking. This approach enhances the security, decentralization, and user autonomy of the Ethereum network.

Key Features of Ether.fi

Non-custodial staking: Unlike many staking services, Ether.fi ensures users maintain control of their private keys throughout the staking process, significantly reducing custodial risk.

Liquidity staking with eETH: When users stake ETH, they receive eETH, a liquidity token that represents their staked assets. This token can be used for lending and yield farming on various DeFi platforms while accumulating staking rewards.

Integration with EigenLayer: Ether.fi has partnered with EigenLayer to provide a re-staking feature that allows users to earn additional rewards by protecting multiple decentralized applications (DApps) at the same time.

Operation Solo Staker: Ether.fi promotes decentralization by allowing individuals to operate their own validator nodes through the Operation Solo Staker program.

ETHFI Token and Its Utility

Ether.fi’s native token ETHFI has multiple functions within the platform:

Governance: ETHFI holders have the right to participate in the governance of the protocol and influence decisions related to treasury management, token utility, and ecosystem development.

Revenue Sharing: Part of the protocol’s monthly revenue is used to buy back ETHFI tokens, which may enhance their value and benefit token holders.

Staking Incentives: Users can stake their ETHFI tokens to earn additional rewards, further incentivizing participation and alignment with the platform’s growth.

Summarize

Ether.fi has become a significant player in the DeFi space, with its TVL exceeding $9.54 billion in December 2024, making it one of the leading re-staking protocols in the Ethereum ecosystem.

Ethena Finance is an Ethereum-based DeFi protocol that provides a crypto-native synthetic dollar called "USDe". Unlike traditional stablecoins that rely on fiat reserves, USDe maintains its peg through a delta hedging strategy and cryptocurrency collateral (primarily Ethereum), a design that provides a censorship-resistant and scalable solution.

Key Features of Ethena Finance

Synthetic Dollar (USDe): USDe is a fully backed synthetic dollar collateralized by crypto assets and managed through delta hedging. This approach ensures stability without relying on the traditional banking system, providing a resilient alternative to the DeFi space.

Internet Bond (sUSDe): By staking USDe, users can obtain sUSDe, a yield asset that the protocol generates over time. This mechanism allows users to earn passive income while maintaining exposure to stable assets.

Delta Hedging Mechanism: Ethena uses Delta hedging, which uses short positions in the derivatives market to offset price fluctuations of collateral assets. This strategy maintains USDe’s peg to the U.S. dollar, ensuring stability even in volatile markets.

Non-custodial and decentralized: Ethena operates without relying on traditional financial infrastructure, providing users with full control over their assets.

Supported collateral assets

Ethena mainly supports Ethereum as collateral for minting USDe. Users can deposit ETH into the protocol to generate USDe, and then stake it to receive sUSDe, thereby participating in the protocol's yield generation mechanism.

ENA Token and Its Utility

Ethena’s native governance token, ENA, plays several key roles in the ecosystem:

Governance: ENA holders can participate in protocol governance and influence decisions related to system upgrades, parameter adjustments, and overall strategic direction through voting.

Staking Rewards: By staking ENA, users can earn sENA, which may accrue additional rewards and provide higher reward multipliers within the protocol’s incentive mechanism.

Summarize

DefiLlama data shows that as of December 2024, Ethena Finance's TVL exceeded US$5.9 billion.

Jito is a liquid staking protocol running on the Solana blockchain that focuses on maximum extractable value (MEV) strategies. By allowing users to stake their SOL tokens in exchange for JitoSOL, a liquid staking token, Jito enables participants to earn staking rewards augmented by MEV revenue.

Key features of Jito

MEV-driven staking rewards: Jito integrates MEV strategies to increase staking rewards. By capturing and redistributing MEV profits, JitoSOL holders can obtain higher returns than traditional staking methods.

Liquidity staking with JitoSOL: After staking SOL, users will receive JitoSOL tokens representing their staked assets. These tokens maintain liquidity, allowing users to participate in various DeFi activities while still receiving staking rewards.

Non-custodial Platform: Jito operates as a non-custodial platform, ensuring that users retain control of their assets.

Enhanced Network Performance: Jito helps improve network performance and reduce spam on the Solana blockchain by staking exclusively with validators running optimized software.

Supported collateral assets

Jito mainly supports the staking of Solana token SOL. Users can stake any amount of SOL and receive JitoSOL in return.

JTO Token and Its Uses

Jito has launched its native token, JTO, which plays multiple roles in the ecosystem:

Governance: JTO holders can participate in protocol governance.

Staking Rewards: By staking JTO, users can receive additional rewards.

Summarize

Jito has achieved significant growth in the Solana ecosystem. According to its website, as of December 2024, more than 14.5 million SOL tokens have been staked through Jito, with approximately 204 Solana validators participating. The platform offers an annualized yield (APY) of more than 8%, reflecting its competitive advantage in the liquid staking market.

A hallmark feature of Jito is the integration of a MEV strategy to boost staking rewards. In addition, Jito’s commitment to open source development is also reflected in the release of Jito-Solana, the first third-party, MEV-enhanced validator client for Solana.

Babylon is a groundbreaking protocol that brings Bitcoin staking to the DeFi ecosystem. By allowing Bitcoin holders to directly stake their assets, Babylon allows users to earn yield while contributing to the security of the Proof-of-Stake blockchain. This innovative approach eliminates the need to bridge, wrap, or transfer BTC to a third-party custodian, thereby maintaining Bitcoin's inherent security and decentralization.

Babylon's main features

Self-custodial staking: Babylon’s protocol allows BTC holders to stake their assets without handing over control to an external entity. Users lock their Bitcoin in self-custody, ensuring full ownership and security throughout the staking process.

Integration with PoS chains: By staking BTC, users can participate in protecting various PoS blockchains, including application chains and decentralized applications (DApps). This integration enhances the security of these networks and rewards stakers in return.

Fast Unbinding: Babylon uses the Bitcoin Timestamp Protocol to enable fast unbinding of pledged BTC. This feature ensures that users can quickly withdraw assets without relying on social consensus, thereby maintaining liquidity and flexibility.

Scalable re-staking: The modular design of the protocol supports scalable re-staking, allowing a single BTC stake to secure multiple PoS chains simultaneously. This feature maximizes earnings potential.

Supported collateral assets

Babylon focuses on using Bitcoin for staking purposes.

Summarize

Babylon has achieved significant results, including the successful launch of its mainnet and the initiation of multiple staking caps. Notably, the protocol’s TVL exceeded $5.7 billion in December 2024.

1. Potential for high returns through yield farming: DeFi staking often offers substantial rewards, especially when combined with yield farming strategies.

2. Enhanced control over funds: Users retain full ownership of their funds through decentralized wallets without relying on third-party custodians.

3. Participate in governance: Staking governance tokens enables users to vote on protocol decisions and influence the future development of the platform.

4. Contribution to network security and operations: By staking, users can help protect the blockchain network and maintain decentralized operations.

5. Liquidity Staking Tokens: Liquidity staking tokens enable users to access staked capital while continuing to earn rewards.

6. Flexibility of income strategies: DeFi staking provides opportunities for a variety of innovative strategies, such as achieving compound interest through re-staking or using staked tokens to participate in other DeFi activities.

7. Access to emerging ecosystems: Staking supports innovation by helping to bootstrap new protocols and ecosystems.

1. Smart contract vulnerabilities: Malicious attacks or vulnerabilities in smart contracts may result in the loss of pledged assets.

2. Impermanent loss in liquidity pools: Changes in token prices may reduce the value of assets in the liquidity pool, thereby affecting overall returns.

3. Token price fluctuations: The volatility of cryptocurrencies may affect the value of staking rewards.

4. Slashing Penalties: In some networks, improper validator behavior may result in penalties that reduce the amount of staked funds.

5. Protocol-specific risks: Emerging platforms may lack sufficient auditing or experience, increasing the risk of operational failure.

6. Lack of liquidity: Pledged assets may be locked for a period of time, limiting the immediate availability of funds.

1. Distribute your stake across multiple platforms: Distribute your staked assets across different protocols to reduce the impact of a single platform failure.

2. Research platform audit and security history: Choose platforms that have a good security record and undergo regular third-party audits to ensure the safety of your funds.

3. Pay attention to token economics and protocol changes: Closely monitor token supply changes, reward mechanisms, and governance decisions that may affect your staking strategy.

4. Take advantage of liquidity staking options: Use protocols that provide liquidity staking tokens to maintain liquidity and flexibility while earning rewards.

5. Set risk limits: To manage your risk exposure, determine the maximum percentage of your portfolio that you want to allocate to staking and stick to it.

6. Use reputable wallets and hardware security devices: Store your staked assets in a secure wallet to prevent potential hacking or phishing attacks.

DeFi staking allows you to earn rewards by supporting blockchain networks, and while the specific steps may vary by protocol, the following provides a general guide:

Step 1: Choose a staking agreement

Research different staking platforms and choose one that aligns with your goals, such as liquidity staking (like Lido Finance or Jito) or yield tokenization (like Pendle Finance).

Consider factors such as supported assets, security measures, and potential returns.

Step 2: Set up your wallet

Choose a non-custodial wallet that’s compatible with the protocol you plan to use, such as MetaMask for Ethereum-based platforms or Phantom for Solana.

Keep your wallet secure by backing up your recovery phrase and enabling two-factor authentication.

Step 3: Get tokens

Purchase the tokens required for staking (e.g. ETH for Lido, SOL for Jito) through a cryptocurrency exchange.

Transfer the tokens to your wallet.

Step 4: Connect to the Staking Protocol

Visit the official website of the protocol (for example, lido.fi , jito.network ).

Follow the prompts to authorize the connection and connect your wallet to the platform.

Step 5: Pledge assets

Select the token you want to stake and determine the amount.

Confirm the pledge transaction and make sure you have enough funds to cover the transaction fee.

In a liquid staking protocol, you will receive a derivative token (such as stETH or JitoSOL) that you can use in the DeFi ecosystem.

Step 6: Monitor and manage your benefits

Regularly track your staking rewards and portfolio performance through the dashboard or the protocol’s interface.

Consider leveraging the yield tokenization capabilities of protocols like Pendle for additional strategies.

How to maximize DeFi staking returns

1. Diversify your staking portfolio: Spread your investments across multiple protocols to minimize risk and optimize returns.

2. Reinvestment Rewards: Use earned rewards to increase your returns by re-staking or participating in yield farming opportunities.

3. Stay informed: Follow updates on protocol governance, token economics, and network upgrades that may impact staking rewards or security.

4. Optimize Gas Fees: Schedule transactions when network activity is low to reduce transaction costs.

5. Explore advanced strategies: Consider using protocols such as Pendle Finance to lock in fixed income or use tokenized assets to speculate on future returns.

7. Use liquidity staking tokens in DeFi: To accumulate additional returns on top of staking rewards, deploy derivative tokens (such as stETH, JitoSOL, etc.) in lending or yield farming.

The above steps and tips will help you get started on your DeFi staking journey and fully unlock the potential to generate passive income in the DeFi ecosystem.

This article explores some of the top platforms that may attract much attention in 2025, including Lido Finance, Pendle Finance, EigenLayer, Ether.fi, Ethena, Jito, and Babylon. While each protocol provides basic staking services, it also has some unique features, such as yield tokenization, re-staking, or Bitcoin staking. Mastering and effectively utilizing these features will be the key to unlocking real returns. As the cryptocurrency market enters a new round of bull market, the DeFi field in 2025 is showing unlimited possibilities. Driven by continuous innovation and widespread adoption, DeFi staking is expected to become an important way for us to obtain rich returns.